Published on 20/09/2024

Updated on 20/09/2024

Is your wealth transfer-ready?

Published on 20/09/2024

Updated on 20/09/2024

Is your wealth transfer-ready?

Wealth transfer from capital founders to their families will happen only once. There is no real-world way of testing this beforehand. This is possibly why 70% of families fail at it. How can you be confident that your family will not lose a third of its wealth because of bad preparation for wealth transfer?

Key takeaways

Wills are not shortcuts to success in family wealth transfers. In most cases, they are outdated, contested, and insufficient.

Avoidance and sidelining are driving failures in equipping family members to act in the event of force majeure.

Prioritize wealth information over static documents. The latter can be restored. Without elaborate information on assets, nothing can be done.

The Danger ahead

All families lose money in wealth transfers from one generation to the next. However, wealth owners, and their families, with assets ranging from $3 million to $99 million, face the highest failure rate. They account for 75% of total losses in both emergency and planned intergenerational transfers.

What are the underlying reasons for this? Owner.One, a client-owned autonomous infrastructure for inventory, control, and transfer of capital and assets data for families who are worth $3M-$99M in assets, conducted the research to find evidence-based answers.

In total, we surveyed 13,500 capital founders across 18 countries. According to the study, the average loss rate is 34%. It is estimated that this incurs losses ranging from $1.2 million to $34 million for these families.

Research conclusions are supported by data on assets with unidentified owners. For bank deposit boxes, the rate is 21%. For luxury homes, it is 16%, and for digital assets, it is 23%.

Acquiring, preserving, and transferring Wealth

It takes business acumen and entrepreneurial skills to build a fortune worth up to $99 million. As first-generation wealth creators, our respondents demonstrated outstanding abilities in both domains.

However, their approach to managing family wealth lacks a comparable level of efficiency. Only 14% of them share pertinent information with their families. This is vital to facilitate the transfer. Conversely, 68% do not disclose any data at all. Moreover, in 98% of cases, wealth-related documents or wills are outdated or non-existent.

If wealth owners applied similar principles to manage their business activities, they would probably run out of business quite quickly. Acquiring, preserving, and transferring wealth demands a different skill set.

At this point, ultra and high-net-worth individuals (U/HNWI) stand on the opposite side of the fence, compared to ultra-rich families with a net worth starting from $100 million. The latter have already established family offices, trusts, or other legal structures to manage their assets.

Our survey revealed that just 0.45% of U/HNWI families have trusts or family offices. In cases where they exist, these structures tend to manage only a portion of the wealth. On average, only 30% of their assets are managed by family offices, trusts, or funds.

As a result, wealth owners with $3 million to $99 million and their families are chronically unprepared for the great wealth transfer. What are other factors contributing to this?

Insecure data storage

Study findings suggest that, on average, up to 31% of family wealth is lost during transfer, due to a lack of comprehensive data on assets. What are the origins of these gaps?

Fully 81% of capital founders prefer to maintain and manage records and store information, regarding family wealth, themselves. Unfortunately, in 97% of cases, they opt for unreliable methods to complete these tasks.

It is indicative that most wealth owners utilize conservative, yet insecure methods. Almost half of this number (49%) simply put documents in a box, and use hand-written notes or spreadsheets.

These practices result in approximately one-sixth of vital information being irretrievably lost annually. Without it, passing Know Your Customer (KYC) procedures or claiming assets becomes a near-impossible task for families.

Information monopoly and asymmetry

In most cases, capital founders gravitate towards becoming the sole owners of family fortune-related information. They monopolize knowledge on asset classes, legal structures, sources of origin, relevant business contacts, instructions and limitations of power of attorney, etc.

This also creates an information vacuum. Wealth founders are reluctant to share their knowledge in advance for two reasons. First, they fear that premature disclosure could trigger intra-family conflicts. Second, younger generations could lose their motivation for education and long-term career planning.

At its core, wealth transfer touches on the most sensitive topics for every individual. Family relations and personal finances are not common topics for conversation, even with close friends or trusted professionals.

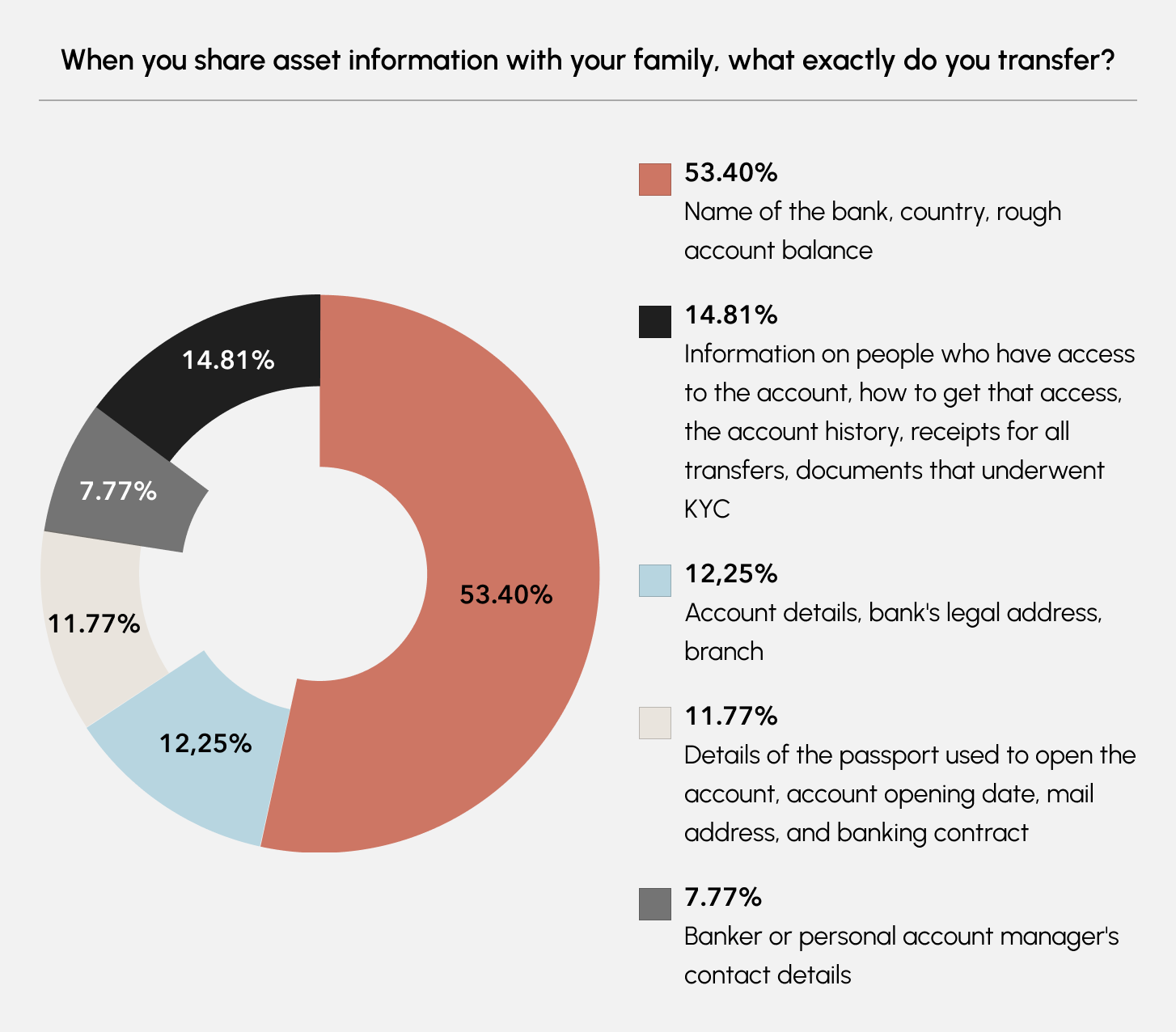

For these reasons, family wealth transfer often becomes an elephant in the room. Understandably, 85% of wealth owners prefer not to disclose any information. Even when they do, the shared data often has no practical value in connection with the family wealth transfer. This could be because of a possible lack of completeness or currency.

The Burden of avoidance

The common misconception is that transferring assets from one generation to the next will be straightforward. The process is perceived as obvious, with no conscious thought given to forward planning.

According to the study, only 6% of wealth owners have drafted or are in the process of drafting a wealth transfer plan. In contrast, the next owner must know up to 20 details, and sometimes even more, about a single asset to be able to claim ownership.

The evolving KYC requirements further complicate the matter. Regulations on capital origins and proofs of ownership continuity tighten when assets and capital are transferred from a wealth owner to successors.

Unfortunately, only 4.5% of all respondents realize the consequences of their inaction. Avoidance of planning ahead shifts the burden onto family members and children. This significantly reduces their chances to successfully gain ownership.

Eight out of ten capital founders do not take any action to resolve the information monopoly problem. This attitude largely contributes to the high family wealth transfer failure rate.

As a result, 93% of respondents openly admitted that they had no understanding of how their family will act in the event of force majeure. Can this be remedied?

Wealth transfer check-Up

Let us look at a step-by-step guide on how to avoid losing millions in the wealth transfer process.

Step 1: Set a framework for the wealth transfer

This is square one. Undoubtedly, family matters can be intricate. Before delving into a full-fledged wealth transfer strategy, take a step back and consider who are all the players in the process. Evaluate the eligibility of both immediate and extended family members. Then, assess how each stakeholder’s needs may influence decisions.

Some may require stable financial support for special care. For the younger generation, you may want to establish education opportunities. Life scenarios vary, but dedicating time to outline your vision and how you can support them or prevent actions you consider unacceptable is key.

Define the recipients, the assets, and the timing. Consider whether to transfer a particular asset entirely or to distribute it in shares among family members.

The best metaphor for family wealth is an iceberg. The largest part of it is always beneath the surface. Examine which vital information, about assets, is unknown to family members. How can you help them overcome this information black hole?

If you want your wealth to have a lasting impact or address significant issues, incorporate this into your planning. Consider the role each family member may play in this.

In case of an emergency, identify the people who can support the transfer process. What are their directions, powers, and instructions?

Step 2: Review your assets and liabilities

To increase the likelihood of a successful transfer, compile comprehensive records of all assets and capital you own during the forward planning phase. Ensure you categorize all asset classes, including bank accounts, brokerage accounts, deposit boxes, real estate, jewelry, digital assets, stocks, bonds, public funds, gemstones, legal entities, and others.

This is crucial, especially in cases of indirect ownership structures. Consider what legal frameworks protect your family’s ownership rights in case of unforeseen events.

Apply the same detailed approach to debts and obligations. These may include mortgages, secured or unsecured debts, or shared or guaranteed obligations like student loans or mortgages for children.

Step 3: First focus on the information, then on the documents

Our research team interviewed over 30 trusted professionals from 7 countries on family wealth transfers. The majority (90%) concluded that for successors, claiming assets is no longer a major issue if comprehensive data is at hand. Success is a matter of following well-established routines and legal procedures.

about which assets to claim, their location, structure, legal status, and other specific details. While one can restore documents, nothing can be done without information about which assets the documents are missing.

In some cases, this document is known as the Source of Funds Memorandum. It is a unique document where capital founders chronicle the creation of their fortunes. The SoWE provides an opportunity to write the history of your family wealth, in your terms and words. All other documents originate from external sources, such as contracts, letters of recommendation, statements, etc.

It is recommended to prepare the SoWE in the language of the countries where your family members hold passports and residence permits. If your asset is located in a country with a different language, consider adding a certified translation of the SoWE in that language as well.

Step 4: Set the right timing

Review the comprehensiveness of documents and their copies for each asset. Financial institutions often require account histories, letters of recommendation, copies of money transfers, proof of ownership continuity, or other data arrays.

You can only do that efficiently on one precondition. That is, if you store all documents, even if they seem unimportant at that moment in time. These could be demanded by financial institutions at short notice. For example, the typical timeline for a bank inquiry is a few days.

Timing is the key factor in the outcome of family wealth transfer. Information must be delivered precisely at the right moment to avoid two major risks.

The first is early disclosure. A family member might be tempted by the prospect of wealth before they are ready to handle the responsibility that comes with it.

The second is the risk of losing assets. Typically, family members have a narrow window, from 3 to 6 months, to claim ownership of assets. Once this period elapses, assets are lost. The rule of thumb should be “Not sooner or later, but just-in-time”. The disclosure process must connect family members, assets, and trusted professionals. All parties involved should be equipped with sufficient data and instructions at the appropriate time.

Four additional questions for family wealth self-review

Which wealth information should be at hand?

Check if you have the following documents:

Letters of recommendation from banks, brokers, or other financial institutions. These letters should be no older than six months.

1, 3, and 10-year cash flow statements for all your accounts, including lists of accounts with their exact opening dates.

Rationales for all large account receipts and expenditures.

Details on the companies that paid your dividends.

Similar data for other large earnings, such as investments and bonds.

A regularly updated Source of Wealth Essay.

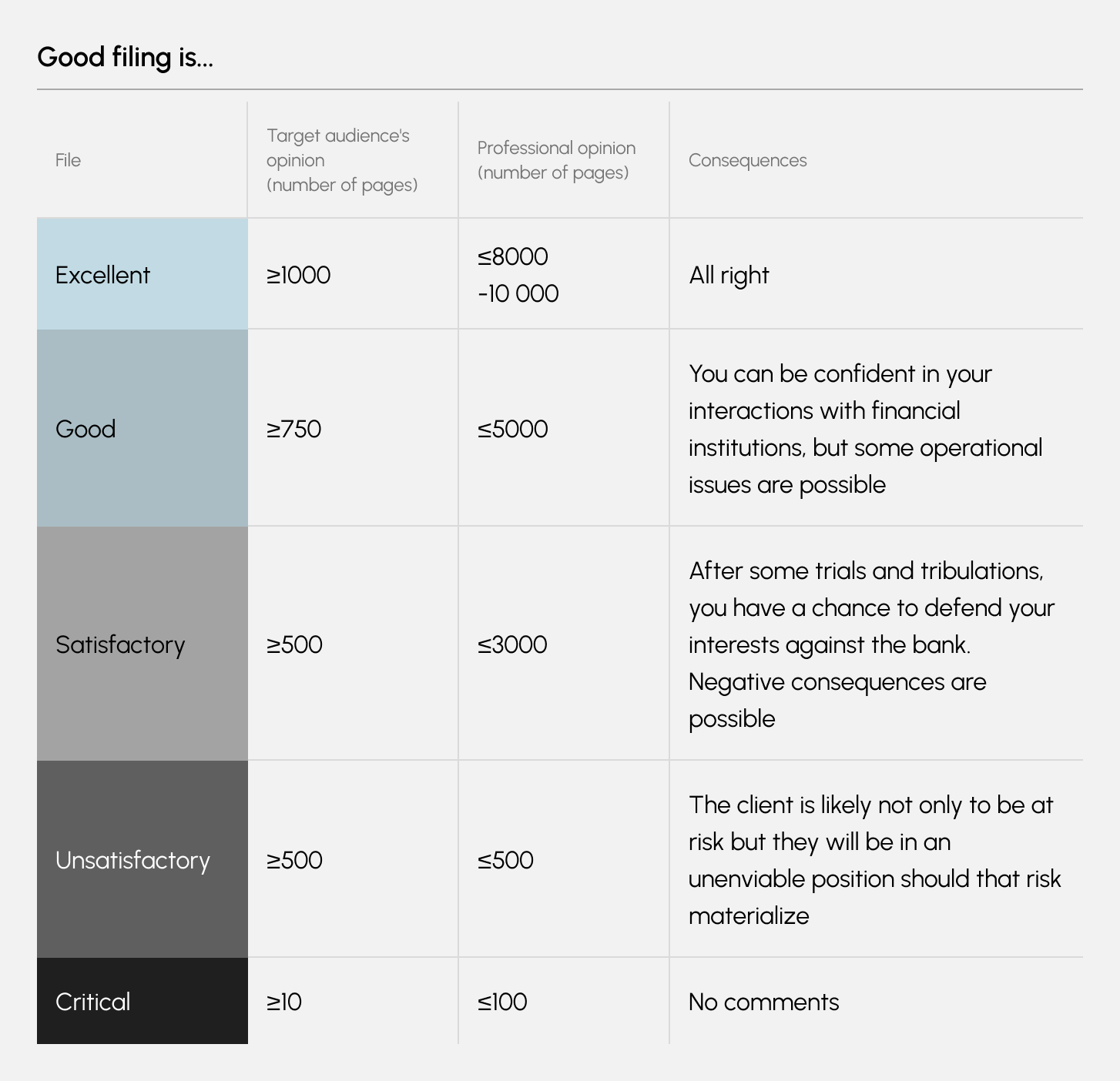

Is there a way to evaluate if my document filing is adequate?

We surveyed both wealth owners and bank compliance officers to clarify their definitions of “good filing”.

The question was straightforward: What is the volume of documents one must possess to confidently interact with financial institutions?

The unit of measurement scale was calculated as the number of pages of text.

Consult the table below to evaluate if your document filing is adequate.

Why is SoWE of primary importance?

At the time of the research, less than 1% of U/HNWIs had elaborate Source of Wealth Essays.

This 1% has documentary support that is detailed enough to substantiate a trustworthy history of the origins of the family’s fortunes.

The importance of a well-crafted SoWE will only increase due to ever-evolving KYC regulations. In the first 5 to 10 years, family members will still rely on the predecessor’s SoWE to interact with financial institutions, proving the origins and ownership of the assets.

To make a bold statement, how wealth owners prepare their SoWE today is how family members will pass KYC requirements tomorrow.

Are wills of no use in family wealth transfers?

In 84% of cases, our respondents do not have wills in place for emergency capital transfers. Even if the capital founder is advancing in age, 72% still do not possess a will.

For families worth up to $99 million, the contested rate for wills is 99.5% in developing markets and 78.7% in developed markets. Approximately 56% of assets and capital are at risk of legal challenges from third parties.

Wills are important, but only to a certain extent. In the modern world, detailed data is more crucial. Without detailed data to claim the asset, the will won’t assist in the transfer.

Professionals point out the problem of executing what is stated in the will, especially if the will needs to be executed across multiple jurisdictions. A safer option might be to make a separate “regional” will for some of your assets, though this is exceedingly rare.

CONCLUSION

Data on wealth transfers outcomes run counter to the common misconceptions of wealth owners and their families. They expect the process to be straightforward. They also underestimate how data-demanding is wealth transfer.

These misconceptions lead to high failure rates. Typically, $340,000 per $1,000,000 is lost in the process of transmitting wealth from the founder to the next generation.

Affluent families account for 75% of total losses in both emergency and planned intergenerational transfers.

In 98% of cases, wealth-related documents or wills are outdated or non-existent.

Fully 97% of wealth owners opt for unreliable methods to store information on family wealth.

Only 6% of wealth owners have drafted or are in the process of drafting a plan for the transfer of wealth.

If you’re looking for more sustainable approaches to wealth transfer planning, consider consulting Owner.One’s services. It equips you with a high-end tech setup to overcome common obstacles in family wealth transfers, mentioned in the article.

Disclaimer

The provided content is intended for informational purposes only and should not be construed as financial or investment advice. We advise all readers to conduct their own research before making any investment or financial decisions.

While Owner.One endeavors to keep the information up-to-date and correct, we make no representations or warranties, express or implied, regarding the completeness, accuracy, reliability, suitability, or availability of the information for any purpose. Any reliance you place on such information is strictly at your own risk.