Published on 10/10/2024

Updated on 12/11/2024

Why switch to blockchain to store your assets and capital data?

Published on 10/10/2024

Updated on 12/11/2024

Why switch to blockchain to store your assets and capital data?

Until now, asset and capital data storage has relied on decades-old technology. This has led to high costs, data breaches, and misconduct by third parties. The introduction of blockchain technology to the wealth industry addresses these issues head-on. Discover how it safeguards your assets and capital information cost-effectively and securely.

Adoption on the rise

Blockchain is one step away from full-fledged adoption by traditional finance (TradFi) institutions. Crypto is its first real-world use case. By 2025, the overall crypto market cap will reach $7.5 trillion. The recent SEC’s approval of the spot bitcoin ETFs for BTC and ETH signals that the adoption wave is nearing.

The wealth industry is typically considered a conservative part of TradFi. Private services and family offices are cornerstones of the industry. The majority of the market players are still running on old business models and tech setups. More importantly, they are rarely able to properly address issues of information asymmetry within wealthy families. The latter is one of the prime reasons for failures in multigenerational wealth transfer, accounting for 31% of total family wealth losses in the process.

But what is the information asymmetry? In short, capital owners avoid disclosing all information about their capital and assets to their families, not wanting to do it too early. However, doing it too late will be impossible. The methods commonly used by most people neither resolve the issue nor allow them to act at the right moment

However, high-income families seek more secure solutions to address the issue. This need is propelled by the following discontents

Outdated tech setups result in costly data storage, limit direct access to the information, and create room for misconduct by third parties.

A labor-intensive process with low levels of automation.

The costs of wealth information storage reach up to $180,000 per year.

Centralized data registries experienced a number of infamous breaches and leaks. It led to private information being unauthorizedly disclosed.

Capital founders understand everything but do nothing

On average, up to $310,000 per $1M of family fortune is lost during wealth transfer due to gaps in asset information.

Families with $3M–$99M in assets face the highest risk in intergenerational handovers, accounting for 75% of total losses.

These conclusions derive from

Owner.One’sPenguin Analytics Report, a comprehensive study surveying 13 500 capital founders across 18 countries.

To date, it is one of the largest global studies on how the rich transfer assets within their families. It evaluates common strategies and risks originating from both planned and force majeure handovers from founders to family members.

Fully 36% of wealth owners are ready to accept a 10-50% loss for a guarantee that the rest will go to the family. Moreover, 86% think their family can't understand data on family assets and capital.

The paradox is that only 4.5% realize their inaction in preventing the information asymmetry shifts the burden of its consequences to their families. The unresolved issue leaves them without the means to tackle the complexities related to intergenerational handovers.

Penguin analytics revealed a lot of immaturity in addressing family wealth transfer challenges. It's a common attitude among high-income families and individuals. However, once they assess the underlying issue behind information asymmetry, they sharply recognize its importance in connection to their family dynamics.

Despite that, no action is being taken afterward. Merely 6% of capital owners have established or are in the process of drafting an assets and capital transfer plan.

The bottom line is that the problem is clear for all the parties involved in wealth transfer. Founders assess risks from gaps in asset data. They are ready to pay to cover them, but not willing to solve them in advance.

This raises an important question: Why is this the case?

Founders’ stress is not remedied

68% find it extremely stressful even to consider how to store and reliably transfer information about their assets and capital to family members.

97.3% opt for insecure methods to store and update their assets and capital data.

Annually every capital founder loses up to 1/6 of all their assets’ history of origin data. That information is difficult or impossible to restore.

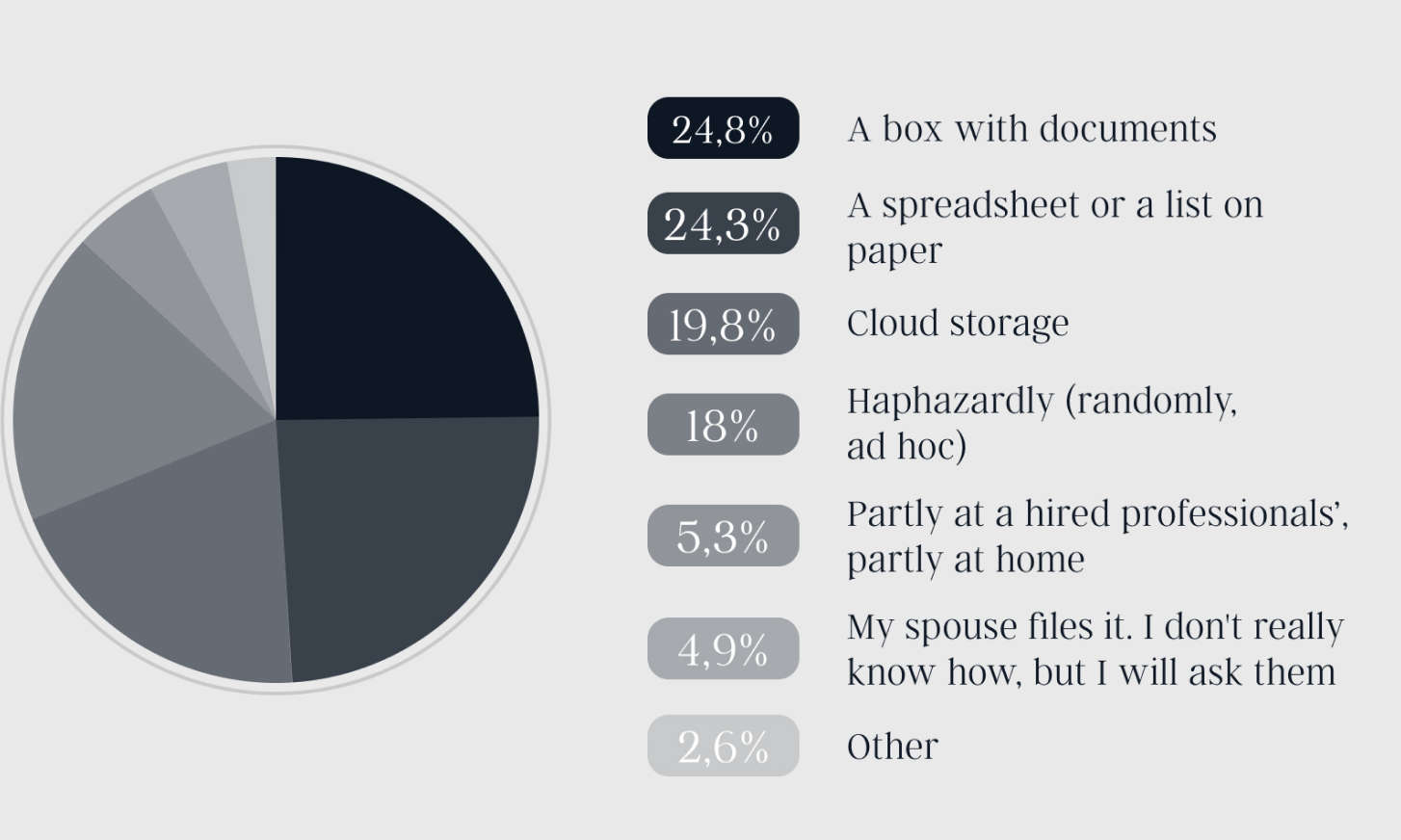

In 81% of cases, owners handle record-keeping and storage themselves. These are their choices for the task:Box of documents in the cabinet -

24.8%Spreadsheet or list on paper -

24.3%Cloud storage -

19.8%Haphazardly (randomly, ad hoc

) - 18%Partly at a hired professionals’ partly at home -

5.3%My spouse files it. I don't really know how, but I will ask -

4.9%Other -

2.6%The breakdown clearly indicates the bedrock of the problem. Illogically, it’s the wealth owners' approach to the family’s money and estate that leaves their loved ones in the most vulnerable position during the wealth transfer.

Is there a better option?

Today, decentralized technology supports applications in many industries. Its expansion is reshaping traditional business processes and models. In finance, it enables quicker and more secure transactions, providing a desirable level of confidentiality.

But how can it address wealth transfer challenges:

How can it ensure 100% safety of assets and capital data?

What guarantees are there for direct access to data when the time comes?

Can eliminating intermediaries also remove the associated extra costs?

We’re inviting wealth owners and their families to take a step-by-step approach to explore all the ways to use decentralized and blockchain technologies for asset and capital data filing and storage.

What are the origins?

Blockchain was designed for Bitcoin users and early cryptocurrency adopters. However, its user base has since expanded to include businesses, governments, and individuals seeking new solutions to old problems in transactions, data storage, and digital trust.

In Q1 2024, Bitcoin became the eighth most valuable asset globally by market cap. With a record high of more than $72,000, its market value rose to $1.42 trillion, surpassing silver.

The success of the BTC ETFs launch accelerated the adoption of underlying technology. More and more banks and other financial institutions are moving to decentralized and blockchain-based solutions to guarantee the efficiency and confidentiality of their client operations.

At its core, blockchain is a decentralized digital ledger that records transactions across a network of computers. It does so in a way that ensures security, transparency, and immutability. Its cornerstone is full data encryption.

Traditional ledgers or databases are controlled by a single entity. Blockchain operates without a central authority. Paired with end-to-end data encryption, it makes access to sensitive client information resistant to the possibility of fraud or breaches—a phenomenon now tightly bound to the wealth information storage approaches of the past decades.

What is a smart contact?

Blockchain offers a new way to handle and secure asset information. For example, it enables the creation of smart contracts, which are self-executing with terms that cannot be amended.

This technology by design eliminates the need for intermediaries. It cuts costs and avoids the complexity associated with similar services in TradFi.

Moreover, it provides unparalleled transparency. Once a transaction is recorded, it cannot be changed or deleted. This provides a secure and accurate history of asset movements and ownership.

The latter is highly valuable in the wealth industry. The crystal-clear level of transaction history is key in facilitating smooth intra-family handovers or preparing for Know Your Customer (KYC) procedures.

No room for middlemen?

For a long time, family offices and private service providers faced little competition. It led to high entry barriers and significant fees for their services.

Blockchain cuts costs by reducing reliance on intermediaries. This change is crucial for the new wave of wealthy individuals whose demands are not currently being met.

Penguin Analytics indicates that these groups have low trust in the existing TradFi offerings. They look for cutting-edge technology to obtain full ownership of their assets and capital data, and its future.

According to Penguin Analytics, the current level of market penetration for family trusts is 0.4% in the HNWI segment. For family offices, the rate is 0.7%.

How secure is it?

Blockchain does not offer absolute security, but it offers more security than any other existing technology in the industry. As of now, no known cases of blockchain breaches are reported.

In a blockchain, encryption is a cornerstone:

All transactions are encrypted. This makes the data unreadable to unauthorized users. Only those with the right keys can decrypt the transaction and view the information.

Participants sign transactions using their private keys, creating digital signatures. These signatures verify the transaction's origin. They ensure that the data was not tampered with and confirm the sender's identity.

What is the use case for family capital?

Decentralized technology may improve family capital operations in two main ways. First, it can digitally encapsulate any asset. Second, it enables data exchange in a decentralized and encrypted manner.

This has opened up new paradigms of asset data storage and transfer. Founders and their family members can exchange data outside conventional TradFi-related structures, avoiding the associated risks. As highlighted in Penguin Analytics, 77.6% more often lawyers act unscrupulously toward successors, than toward capital founders.

The new technology allows founders to store a master copy of their assets and capital data in a decentralized way. What are the benefits? Even if an attacker compromises one server, the information stays fragmented and encrypted, ensuring that unauthorized people will not access it.

Is it regulated

The global regulatory landscape continues to evolve across jurisdictions. In the U.S., it is unclear if decentralized ledgers can be the main source for ownership records.

In contrast, some countries have passed such laws. These countries include Germany, Luxembourg, and Singapore. They officially enable blockchain record-keeping.

Smart contracts may also serve as legal proof of the capital founder’s will if needed. Since 2018, some US states and EU countries, Switzerland, Singapore, and the UAE have started developing case law. These laws treat digital solutions (like smart contracts) as complete alternatives to wills.

The industry outlook

Banks and financial firms are increasingly focusing on DeFi. Several prominent traditional finance firms, including BlackRock, HSBC, BNP Paribas Securities, and BNY Mellon, have recently invested in a range of DeFi projects, each targeting different areas within the digital assets space, including the use of blockchain to tokenize real-world assets.

However, at the moment, there is limited utilization of DeFi and blockchain capabilities for multigenerational wealth transfer issues.

Anticipated, yet non-existing solution

71.4% of capital founders are willing to rely on a third party for the transfer if it can be done without human involvement. Currently, there are no products or services that offer such capabilities.

Wealthy individuals are eager for a solution to the challenges posed by wealth transfers. Penguin Analytics indicates that they opt for a single, digital infrastructure that can cut out intermediaries and human-related risks in intra-families handovers.

This vision agrees with the findings in Capgemini's 2023 report. The report envisions a future dominated by digital services under a Wealth-as-a-Service model. Presently, no such products are available on the market.

Owner.One’s research team gathered insights on the desirable features of wealth transfer assistance service from the target audience–capital owners with a net worth ranging from $3m to $99m. Interviewees outlined the objectives as follows:

Storing extensive data and attributes on assets. Storing document copies was not an A-level priority.

Ensuring secure transmission of asset information to family members or authorized individuals.

The capability to pre-set the precise timing or conditions under which the wealth data transfer will be initiated.

Client apps from brokers, insurers, banks, and payment firms fall short of meeting these needs through a single and holistic digital infrastructure. They serve as mere communication channels between customers and institutions. Their main aim is to simplify client operations and reduce corporate expenses.

In Penguin Analytics, we sampled about 240 software programs used by family offices, lawyers, advisors, and other industry players.

Some of them (30%) mimic online products but they are really just marketing products. Businesses utilize them to find clients and direct them into offline interactions.

About 50% are similar to banking apps. They enhance current client communications.

The rest (20%) are marketing products. They promote online investment-focused products and services under the guise of handling family assets and capital.

Notably, we identified no scam apps in a sampled range. The lack of fraud in this area is, of course, encouraging. However, it also suggests that the industry does not attract leading actors, as scammers tend to follow them.

So, it is reasonable to state that the market does not offer any services that:Enable users to create a personal assets data repository.

Grant data ownership to the client rather than a financial institution.

Replace intermediaries with algorithms in the family capital information transfer chain.

Provide secure and encrypted data storage.

Enable capital founders to share their assets and capital information with family members at the right moment.

What is Owner.One?

enables algorithmic hands-free transfer of assets data from a capital founder to family members.

Wealth transfer self-acting algorithms will work automatically, never too early, never too late, but just-in-time. It will be triggered by life events, outlined by the owner and will reach the addressee.

Wealth owners acquire a client-owned autonomous infrastructure for inventory, control, and transfer of capital and assets data. No third parties are needed. Owner.One is designed for individuals with assets worth $3M to $99M.

What are Owner.One’s key features?

Our service helps capital founders. They can easily prepare data on assets and capital for transfer. They can transfer it to family or other chosen people.

Here are the top five features, available only via Owner.One

The single and secure server to store all information about your family’s wealth. Owner.One acts only as a browser for uploads and edits, while MyHub functions independently. No third parties, including Owner.One, will have access to your data.

Choose from 40+ asset classes. Each comes with a dedicated template. Utilize templates to upload information on your assets and capital. Use the quick start feature to speed up data entry. Once filled in, wealth information is transfer-ready. Delegate data entry to assistants or trusted professionals. They will perform the task in a secure and restricted environment, with no ability to view any sensitive information.

Track your portfolio's performance across different asset types, jurisdictions, and generations. Filter data by currency, value, liquidity, and other parameters to gain a 360-degree view of your wealth.

Wealth transfer self-acting algorithms will work automatically, never too early, never too late, but just-in-time. It will be triggered by life events, outlined by the owner and will reach the addressee. A family member will receive all required information to claim ownership. No extra approval or permission is needed for them to access the data. It will be delivered by self-acting algorithms and made available to them through the Owner.One app.

Is Owner.One encrypted?

Owner.One is blockchain-based. It ensures no third party can access customer data, not even Owner.One.

Within Owner.One, all data is encrypted with a user's unique key. The user keeps this key. It ensures their sole right to decrypt. This ensures that no one, not even Owner.One itself, can access this information.

Multiple independent servers distribute and store data in pieces. The assembly of information happens on the client's device. This adds an extra layer of protection. Even if someone breaches a server, the information remains fragmented and encrypted. Backup copies are also encrypted. They are also stored in pieces on many servers. This offers more protection.

You can learn more on our product page. It details how Owner.One helps you keep your assets and capital data transfer-ready.

ARTICLE SUMMARY

The move from a traditional to a decentralized setup cuts costs. It also boosts security.

A survey of 13 500 capital founders across 18 countries revealed high risks of data gaps for family wealth transfer. High-net-worth families lose more than others.

Decentralized solutions remove middleman dependency in intra-family handovers.

Owner.One ensures users own their assets and capital data. It enables secure assets and capital data transfer from a capital founder to family members. No third parties are needed.